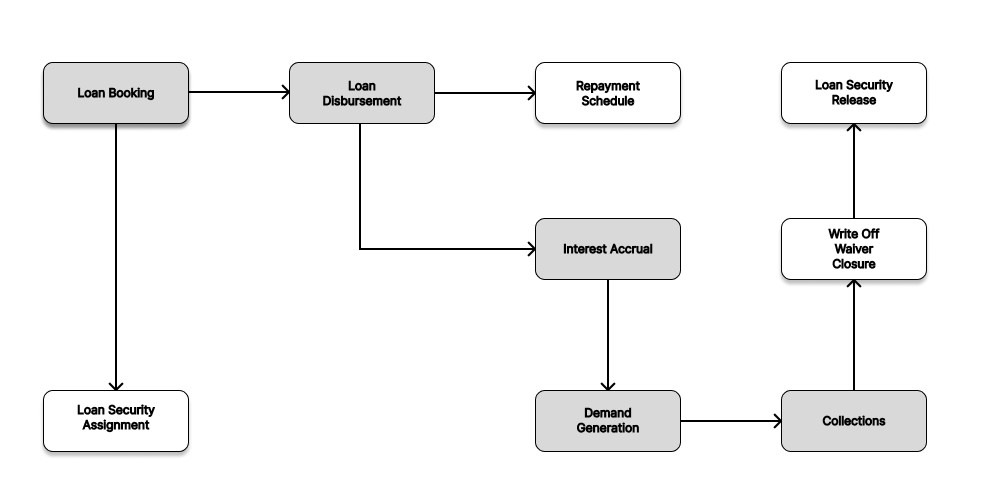

Loan booking refers to the process of officially recording a loan in the financial institution's system after it has been approved and the terms have been finalized. This is a critical step in the loan lifecycle, as it marks the point at which the loan becomes an active obligation for both the lender and the borrower.

To access the Loan, go to:

Home > Lending > Loan > Loan

1. Prerequisites

Before creating a Loan Product, it is advised to create the following:

- Applicant (Customer, Employee, or a Member)

- Company

- Loan Product

2. How to create a Loan

Go to the Loan List, and click on Add Loan.

Enter the loan details like loan product, applicant, tenure, posting date, etc.

Save

Repayment Frequencies

Irrespective of the repayment schedule type users can select a frequency like Monthly, Weekly, Bi-weekly, Quarterly, One Time as per their requirement. Based on this frequency the repayment schedule will be generated.

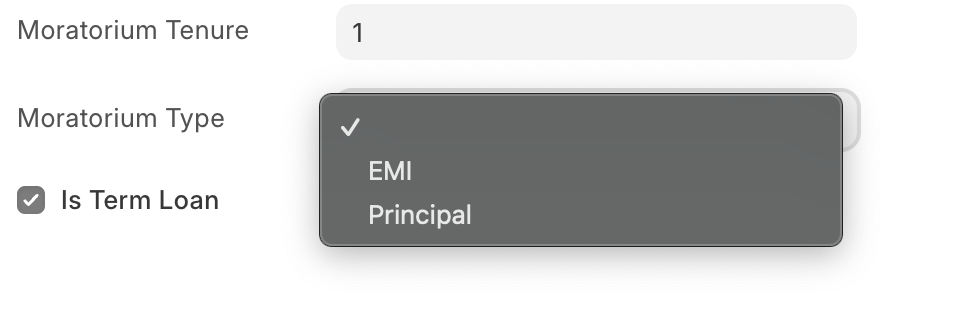

- Adding moratorium during loan booking

A moratorium in a loan context refers to a temporary suspension or postponement of loan repayments for a specified period of time, during which the borrower is not required to make any payments towards the loan principal or interest. The moratorium period is usually granted during times of financial hardship, economic downturns, or in special circumstances such as the COVID-19 pandemic. It allows borrowers relief from financial stress, giving them time to stabilize their finances before resuming regular loan payments.

To add a moratorium, the user can mention the Moratorium Tenure and moratorium type at the loan booking stage

There are two moratorium types available, if EMI is selected, both interest and principal are not applicable and if the Principal is selected the only interest is payable, and the principal component is not applicable.

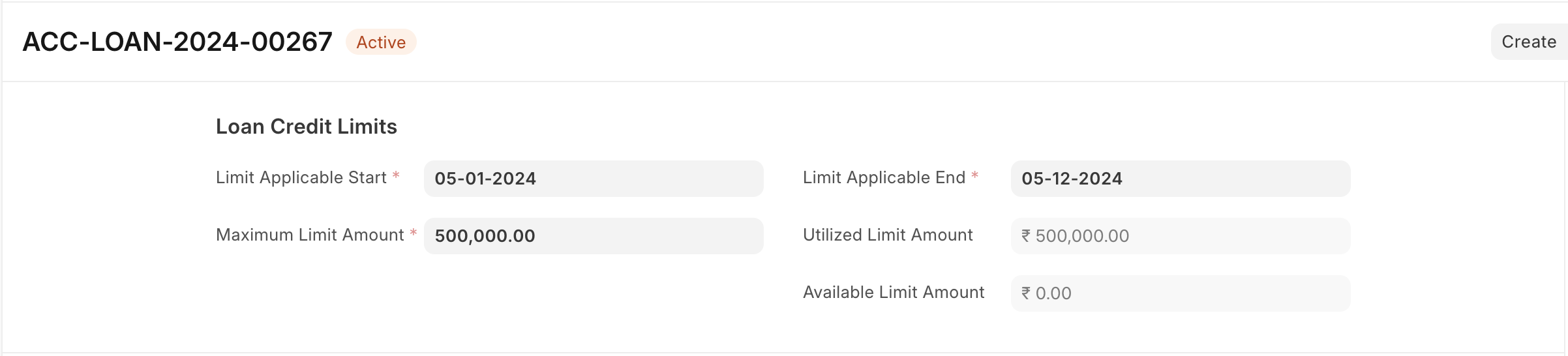

- Revolving limits for Line Of Credit loans

Revolving limits in line of credit loans refer to the maximum amount of credit that a borrower can access and use on a recurring basis. A line of credit (LOC) is a flexible loan option that allows borrowers to draw funds as needed, up to a specified credit limit, repay the borrowed amount, and then access the credit again without having to apply for a new loan. This process is known as revolving credit because the credit becomes available again as the borrower repays it, up to the original limit.

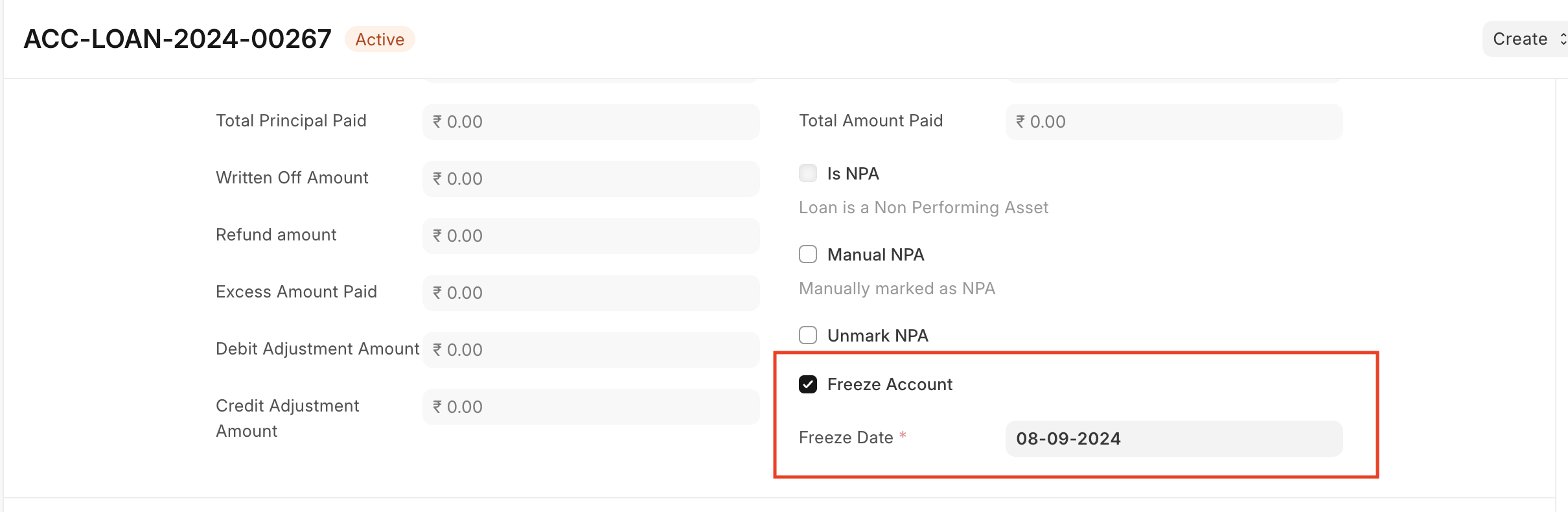

- Loan Account Freezing (Death Marking)

If the borrower dies or is unable to make the repayments due to any circumstances the loan account can be frozen. Upon freezing the accounts the loan interest accrual and demand generation stops.