Loan repayment refers to the process of paying back the borrowed amount (loan principal) along with any interest and fees over a specified period, according to the terms agreed upon between the borrower and the lender. Loan repayment can occur through periodic payments (monthly, quarterly, etc.) or in a lump sum, depending on the loan agreement.

To access the Loan Repayment, go to:

Home > Lending > Disbursement and Repayment > Loan Repayment

1. How to create a Loan Repayment

- Go to the Loan Repayment List, and click on Add Loan Repayment.

- Enter the loan account, repayment type and the amount to be repaid.

- Save and submit

2. Collection Offset Sequences

A Collection Offset Sequence in Loan Repayment refers to a structured system or method used by lenders to determine how payments made by a borrower are applied to various components of a loan. This matrix specifies the order in which payments are allocated between principal, interest, fees, penalties, and other charges. The purpose of an allocation matrix is to ensure transparency in how loan repayments are distributed, especially when the borrower makes partial payments or extra payments outside the regular schedule.

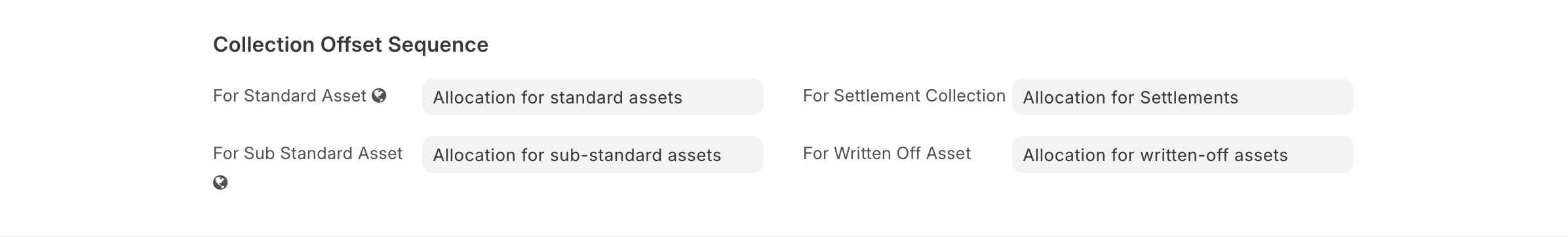

Frappe Lending allows users to define 4 collection offset sequences under the loan tab in the company master

- For Standard Assets (Non NPA Loans)

- For Sub-standard Assetes (NPA Loans)

- For Settlement Collection

- For Written Off Assets

3. Advance and Pre Payment

Whenever a borrower makes an Advance/Pre-payment the loan is rescheduled and a new repayment schedule is generated based on the type of payment.

- Advance Payment

A payment is categorized as an advance payment when the user pays more than the overdue amount and the excess amount paid is more than one EMI amount but less than the two EMI amounts. In case of Advance Payment the upcoming EMI is skipped as the payment made is considered the advance payment for the next EMI.

- Pre Payment

Any excess payment that is not an advance payment is considered a pre-payment. In pre-payment any excess payment amount post deducting the accrued interest is allocated towards the principal and the upcoming EMI is not skipped.

In both the payment types the EMI amount remains the same but the tenure or last payment is adjusted if required.