Loan Interest Accrual

In accounting, accrued interest refers to the amount of interest that has been incurred, as of a specific date, on a loan or other financial obligation but has not yet been paid out. Accrued interest can either be in the form of accrued interest revenue, for the lender, or accrued interest expense, for the borrower.

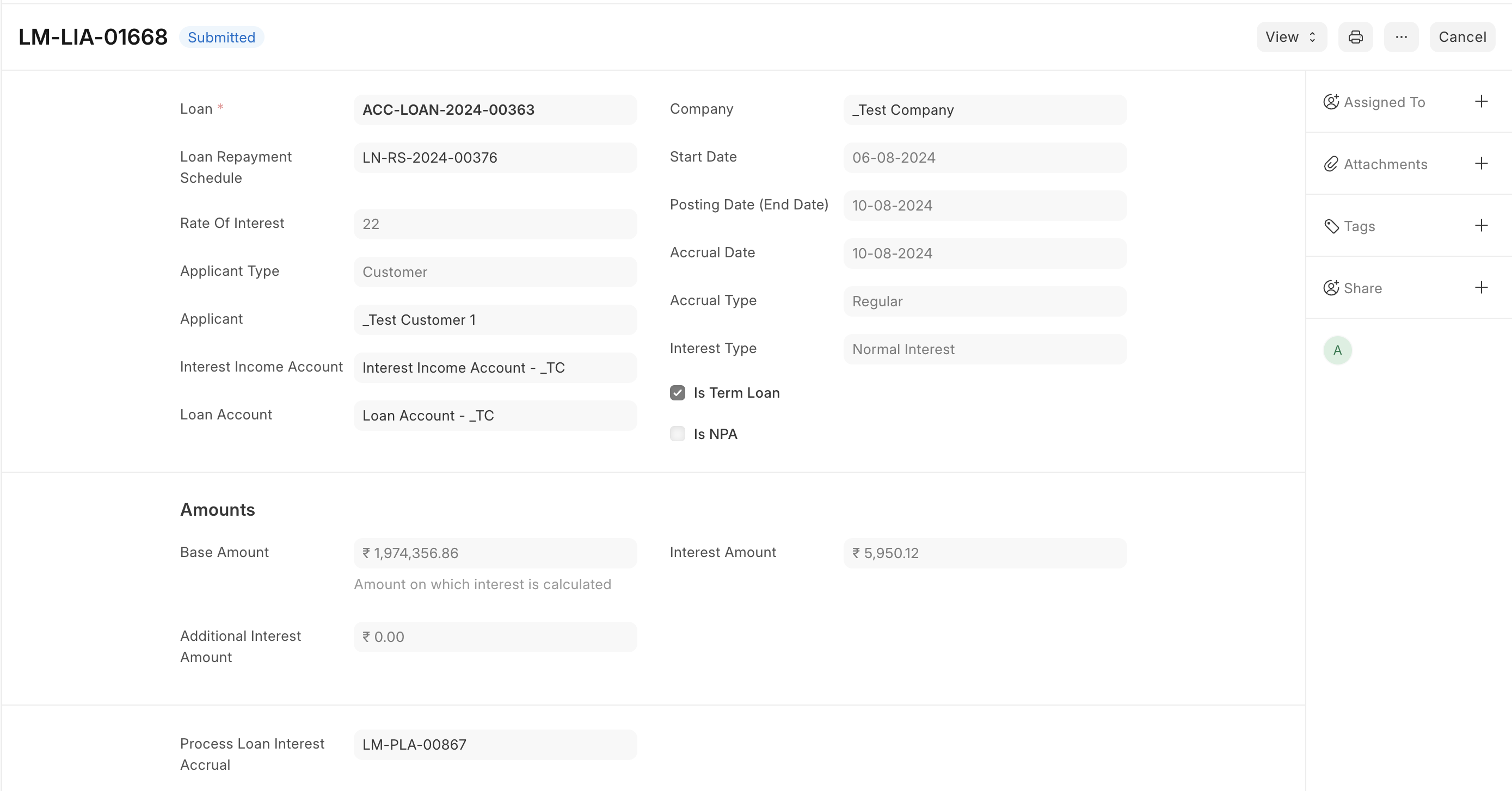

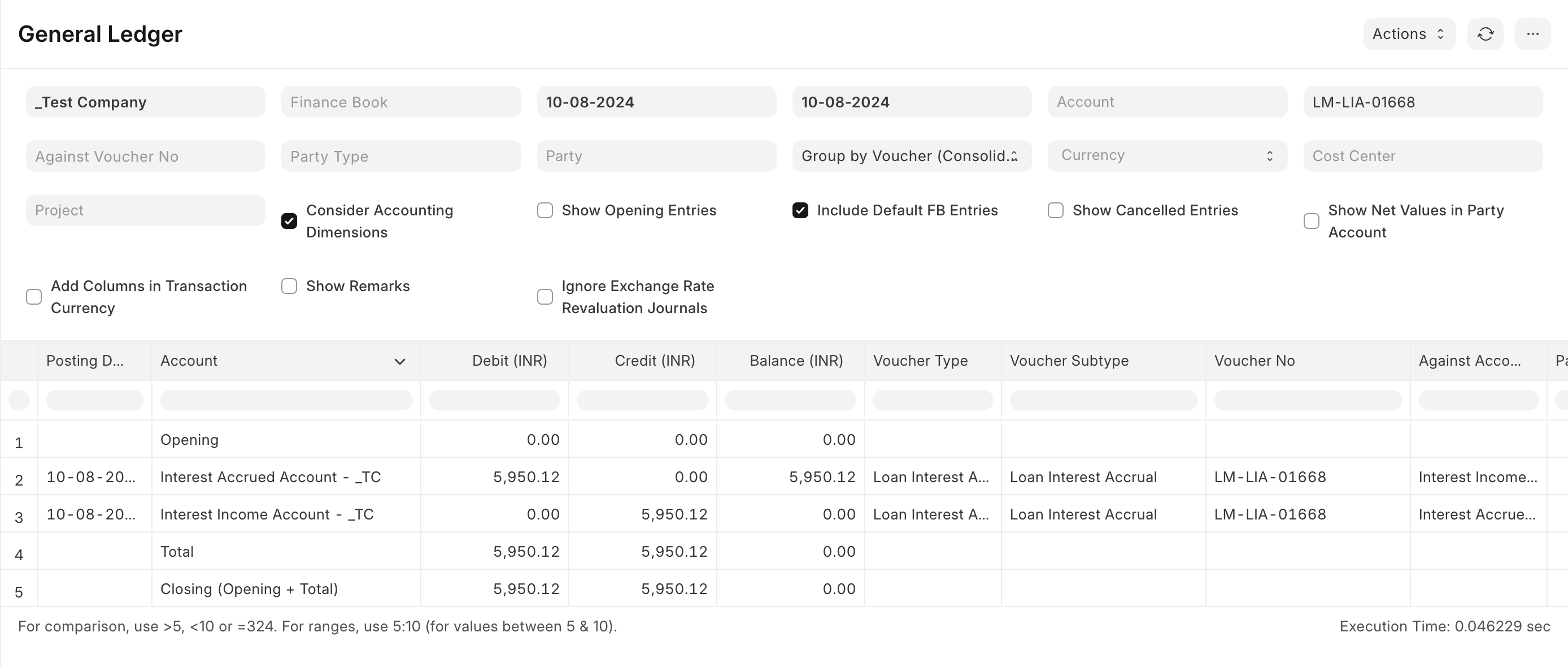

In Frappe Lending, interest accrual happens on a daily basis via a background job. During this accrual process, the amount of interest accumulated between the previous interest accrual date and the process execution date is booked as income and the accounting entries are posted below. This amount temporarily sits in the interest accrued account until the demand for this amount is generated.

There are two types of interest accrual posted

- Normal Interest Accrual

Normal Interest is the standard interest charged as per the loan’s terms, reflecting the cost of borrowing 2. Penalty Interest Accrual

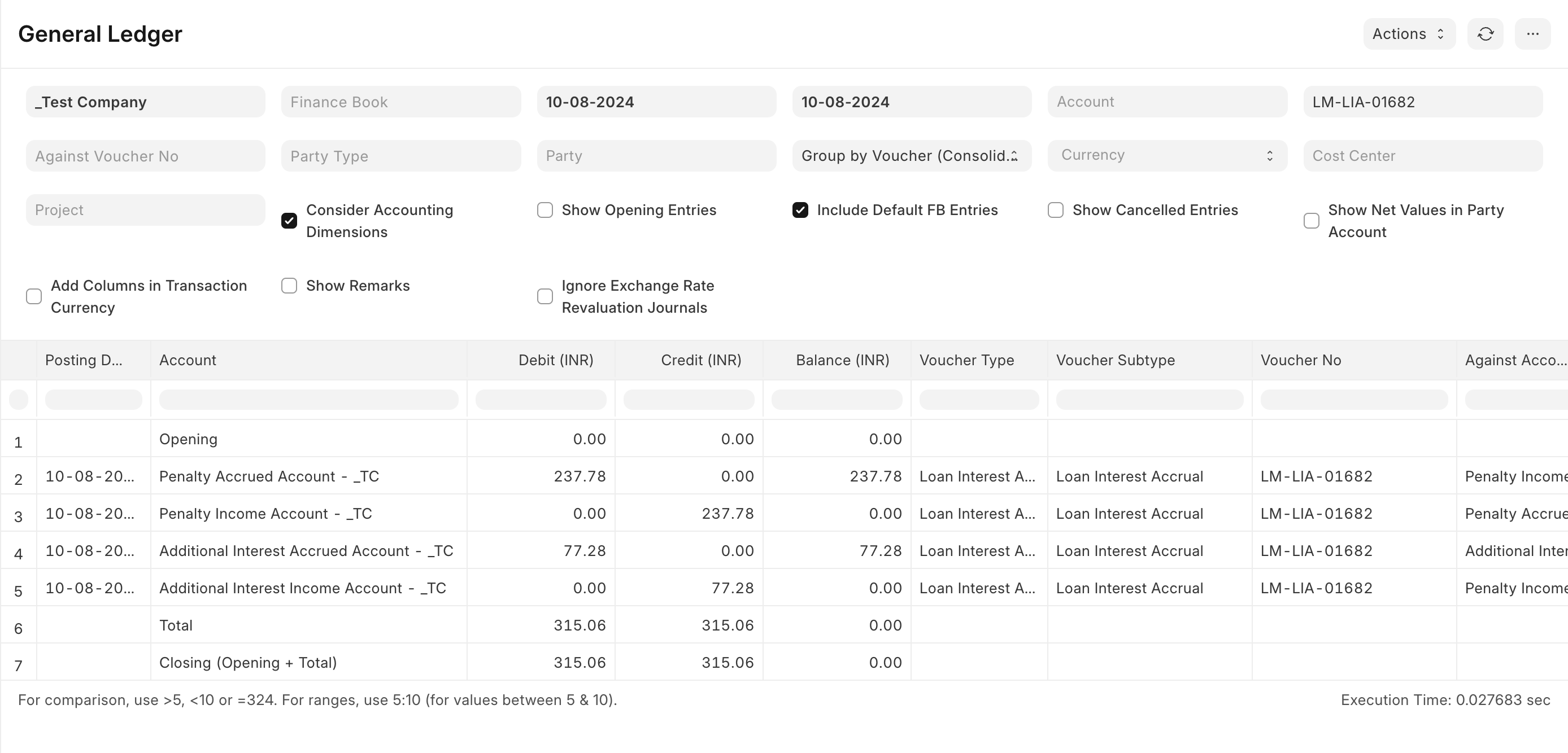

Penal Interest accrual is the interest imposed as a penalty by the borrower on the loan repayment amount that is delayed. This amount is charged on the entire outstanding EMI which includes both pending interest and principal amount. Out of this entire penal amount, the penalty charged on the interest portion is booked as additional interest for internal accounting purposes. The Acc Entries posted will be as follows.