Co-lending in loans refers to a partnership between two or more lenders, to jointly provide loans to borrowers. In a co-lending model, both lenders contribute funds to the loan, share the risks and rewards, and provide more accessible and affordable credit to a broader range of customers. This model has gained popularity as it allows NBFCs to leverage the lower cost of funds from banks, while banks benefit from the NBFC's reach and expertise in specific markets, particularly in underserved or rural areas.

Frappe Lending allows users to onboard and manage these operations for a co-lender using the Loan Partner document.

To access the Loan Partner, go to:

Home > Lending > Co-Lending > Loan Partner

1. How to create a Loan Partner

- Go to the Loan Partner List, and click on Add Loan Partner.

- Add partner code, partner name, partner loan share percentage, and repayment schedule type.

- Save

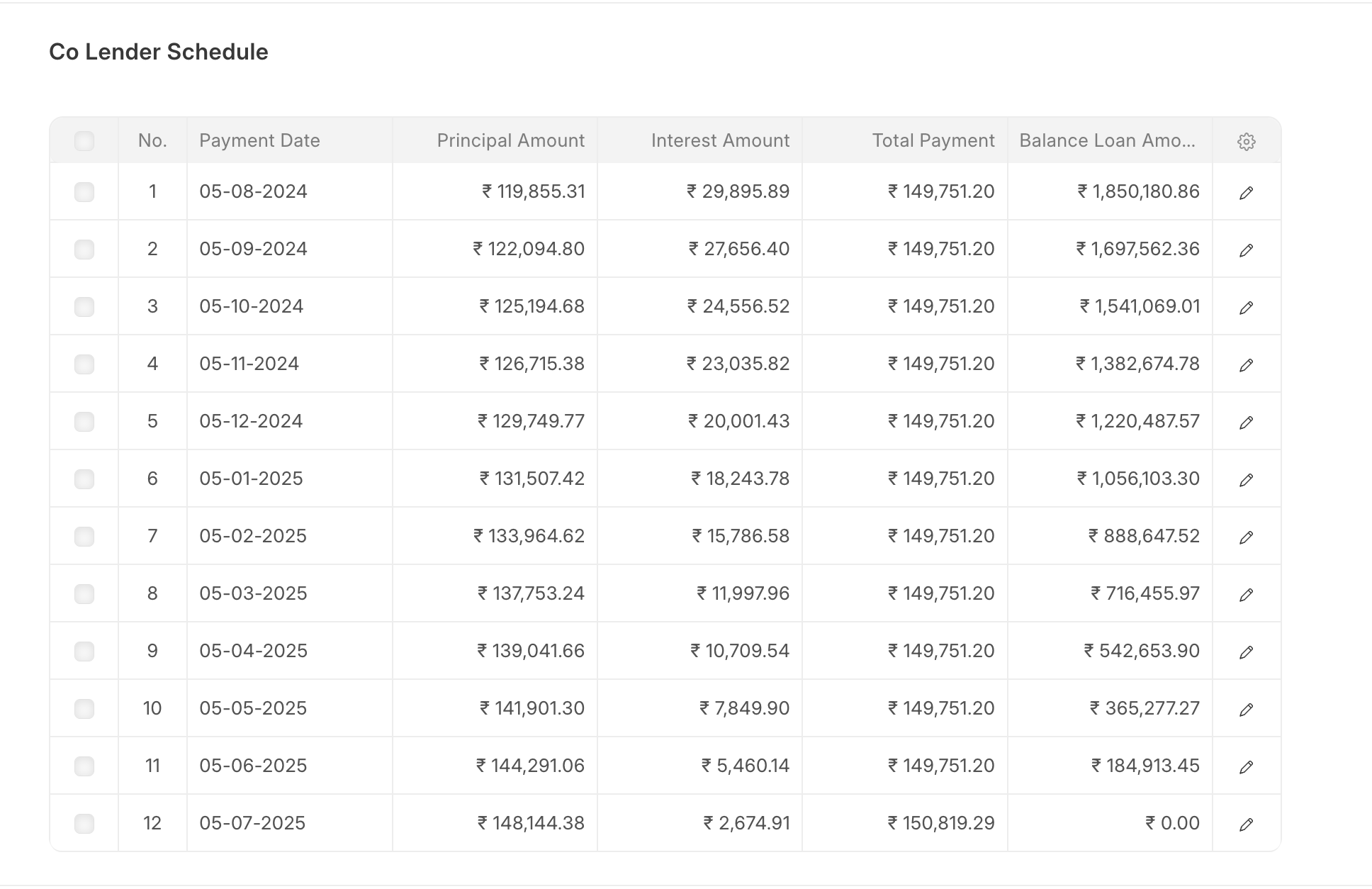

2. Co-Lender Repayment Schedule

Once a loan partner is tagged to a loan whenever the loan disbursement is done, along with the borrower schedule a co-lender schedule is also created to track the co-lender share in a loan.

2. Co-Lender Accounting

During the disbursements and repayment accounting entries for the amounts payable to the co-lender are also posted