NPA (Non-Performing Asset) classification in loans refers to the categorization of loans that are overdue for a specified period and are no longer generating income. In simple terms, when a borrower fails to make principal or interest payments for an extended period, the loan is classified as an NPA by the lender. NPA classification helps financial institutions monitor the quality of their loan portfolios and ensure they take necessary actions to manage risks.

Frappe lending has out of the box NPA classification processes that help users manage NPA loans efficiently.

- Days Past Due update

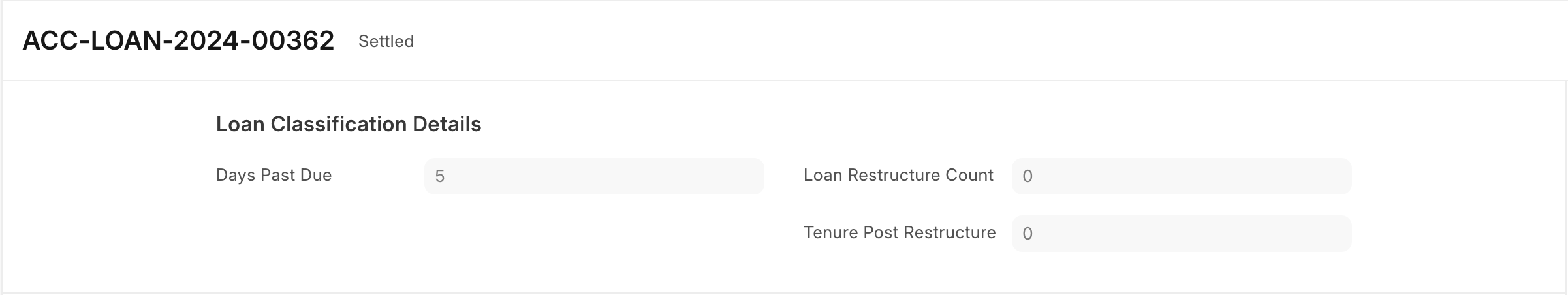

Loan Classification process runs every day to which updates the count of days past due for each active loan. This count is also updated in realtime as soon as a payment is posted.

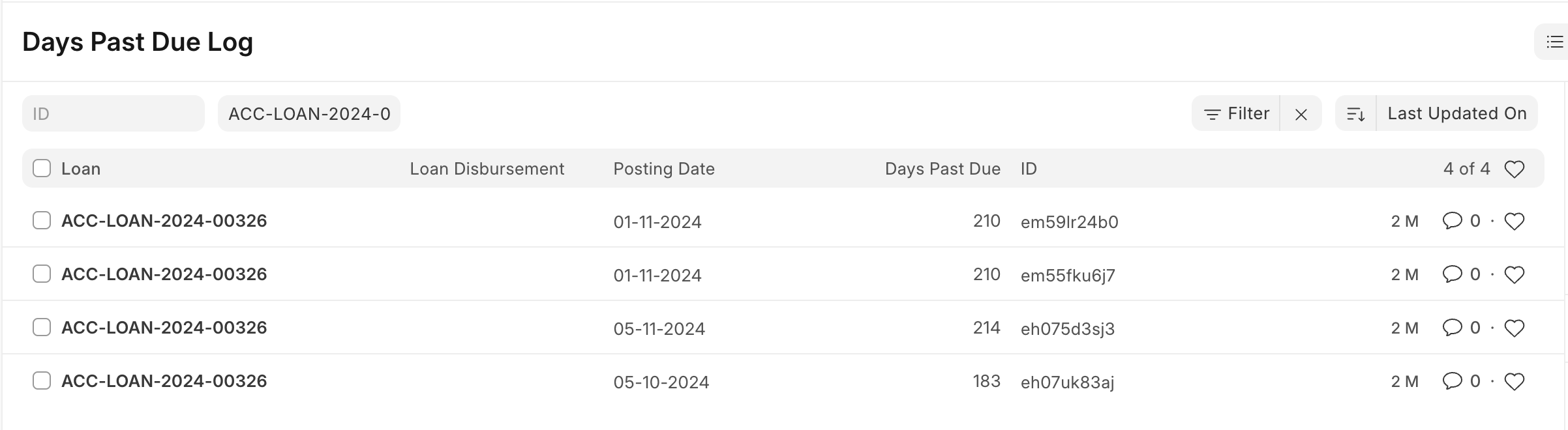

Users can also track historical day-wise data for this in the Days Past Due Logs

- NPA Marking

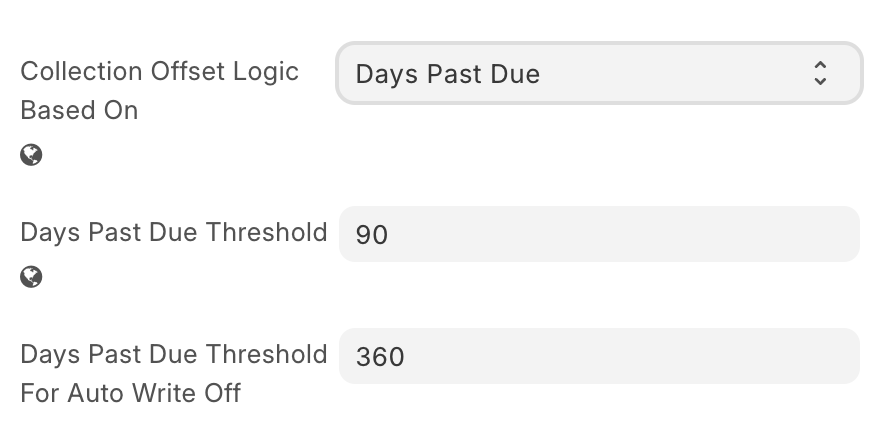

Based on the thresholds configured in the company master whenever the DPD crosses the configured value the loan is marked as NPA

This threshold value is calculated from the oldest overdue EMI demand. And once this value is above the configured limit, the loan is auto-marked as NPA.

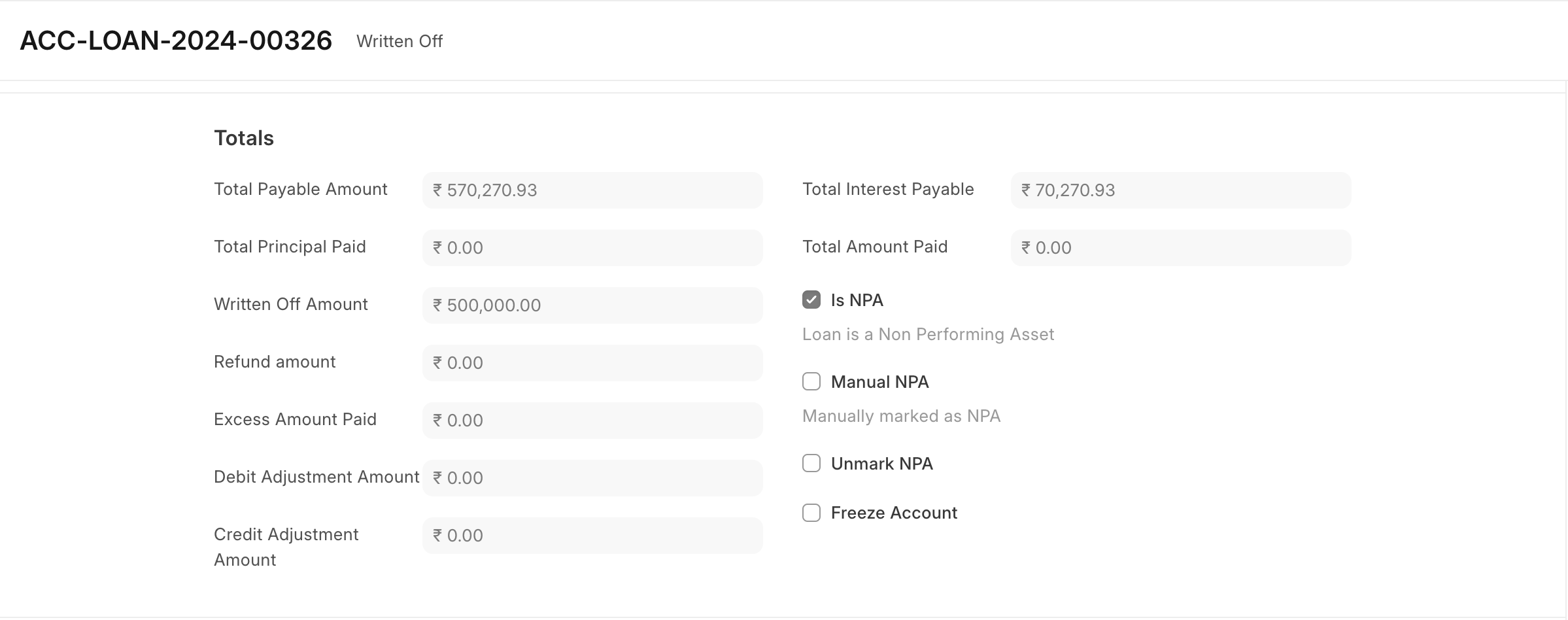

- Manual NPA marking and unmarking

There are cases when the user wants to override the system behavior and manually mark or unmark the loan as NPA even without the configured/required conditions being met. For this, the user can manually mark or unmark the loan as NPA. Once the loan is marked or unmarked as NPA the system processes won't override the user-updated values until user manually unchecks again