A loan product can be categorized as an offering given by a NBFC or a Bank to its borrowers.

Frappe Lending allows users to define different loan products along with their various attributes like the rate of interest, schedule type, etc.

To access the Loan Product, go to:

Home > Lending > Loan > Loan Product

- Prerequisites

Before creating a Loan Product, it is advised to create the following:

- Company

- Loan Category

- How to create a Loan Product

Go to the Loan Product List, and click on Add Loan Product.

Enter the loan product details like product code, product name, rate of interest, repayment schedule type, accounting info, etc.

Save

Repayment/Amortization Schedule Types

1. Monthly as per repayment start date

If this option is selected a monthly repayment schedule is generated upon loan disbursement as per the repayment start date selected by the user. An example of this can be seen in the image below. For this option, there can only be one active repayment schedule at a time, so if multiple partial/tranches are disbursed for this schedule type then a new active repayment schedule is generated and the old schedule is marked as inactive. Here users can also change the frequency of payment to weekly, quarterly, or one-time instead of the monthly default.

2. Pro-rated calendar months

If this option is selected a monthly repayment schedule is generated upon loan disbursement with the payment details as per calendar months. In this option user also gets to choose whether the payment date should be the "End of the current month" or "Start of the next month". An example of this can be seen in the image below. For this option as well there can be only one repayment schedule at a time.

3. Monthly as per cycle date

If this option is selected a monthly repayment schedule is generated upon loan disbursement as per the cyclic date selected by the user in the loan product, however user can override this at the time of loan booking. An example of this can be seen in the image below. For this option as well there can be only one repayment schedule at a time. Here also users can change the frequency of payment to weekly, quarterly, or one-time instead of the monthly default.

4. Line of Credit

This repayment schedule is useful for line of credit loans where an upper limit is sanctioned and multiple disbursements are made within the limit. For this repayment type there can be multiple active repayment schedules with different payment frequencies.

- Excess amount acceptance and auto write-off limits

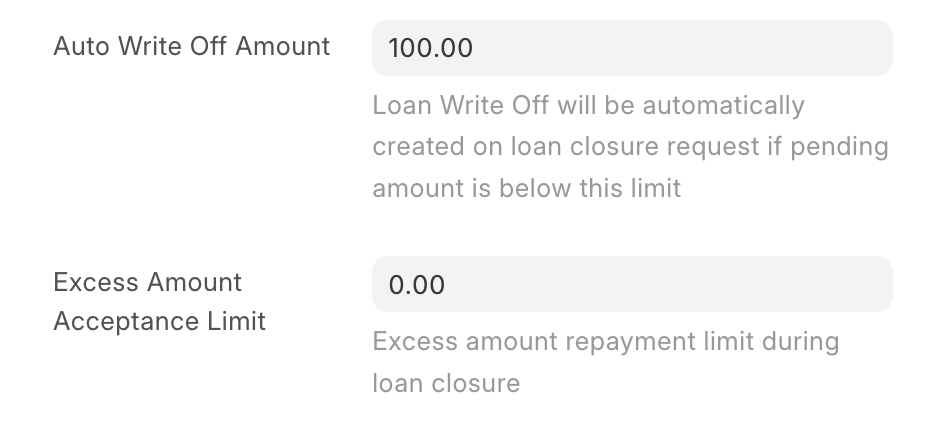

If the final repayment made is short of some amount and the amount is within "Auto Write Off Limit" the amount will be auto-waived and the loan will be closed.

Similarly, in case the borrower makes the final payment with some excess amount and the amount is within the acceptance limit, the amount is parked in the customer refund account and the loan is closed. If the excess amount is more than the acceptance limit, the amount is still parked in customer refund account but the loan still remains open.