Loan restructuring is the process of modifying the terms of an existing loan agreement between a borrower and a lender. This is typically done to help the borrower manage their debt more effectively, especially if they are experiencing financial difficulties that make it challenging to meet the original loan terms. Loan restructuring can involve changes in the interest rate, repayment schedule, loan tenure, or even the principal amount.

Frappe Lending allows users to define different loan products along with their various attributes like the rate of interest, schedule type, etc.

To access the Loan Restructure, go to:

Home > Lending > Loan > Loan Restructure

2. How to create a Loan Restructure

- Go to the Loan Restructure List, and click on Add Loan Restructure.

- Select the loan account and fill in the restructure date, previous details will be automatically fetched.

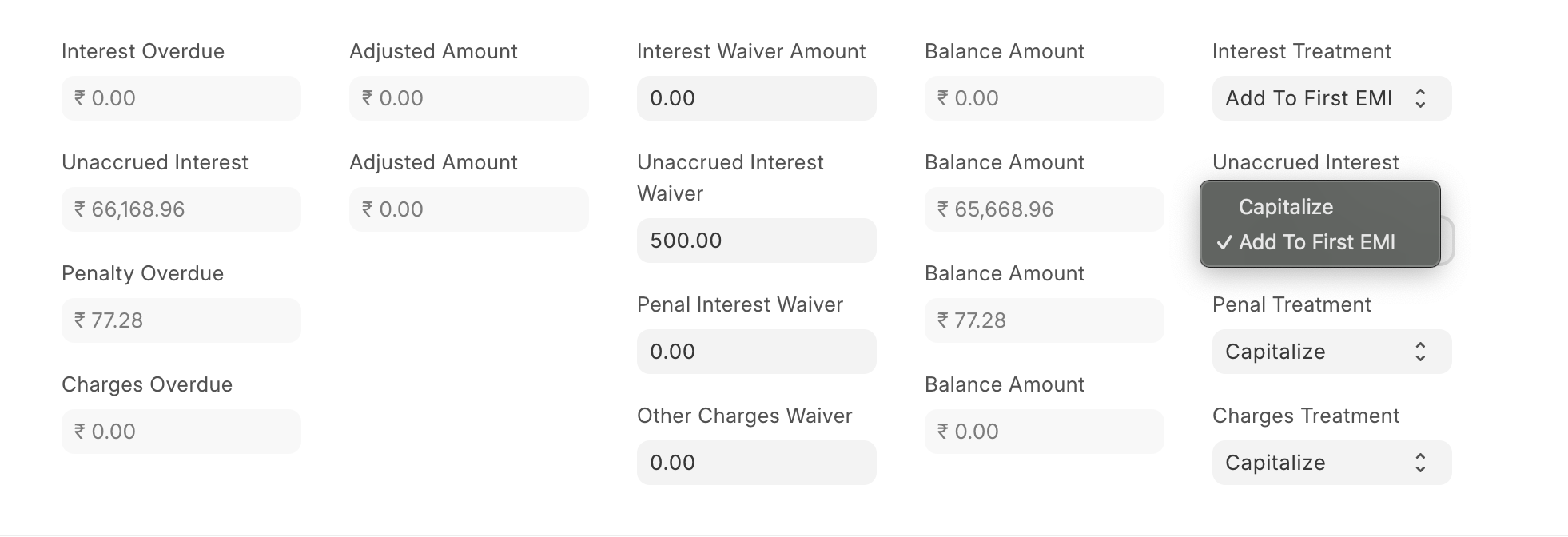

- Fill in the details like new tenure, new interest rate, how previous pending interest and penalties are to be handled, if the security deposit has to be adjusted in principle, and lastly, select the new repayment start date and save.

- A new restructured repayment schedule will be generated as per the new terms selected. Verify and submit the restructure.

3. Capitalization of due interest and charges

During restructuring, users have an option of how the pending accrued/unbooked interest and charges should be treated. They can either add that amount to the first EMI post-restructure or Capitalize (add the pending amount to the principal amount).