A loan waiver refers to the cancellation or forgiveness of the interest or charge component of a loan for a specific period or in particular circumstances. This means that the borrower is either not required to pay the interest accrued on the loan, or the lender refunds or credits the interest that has already been paid.

To make a waiver, go to:

Home > Lending > Disbursement and Repayment > Loan Repayment

1. How to create a Loan Waiver

- Go to the Loan Repayment List, and click on Add Loan Repayment.

- Select the repayment type as Interest, Penalty, or Charges Waiver.

- Select the loan account number against which the waiver is done and enter the waiver amount.

- Save and submit.

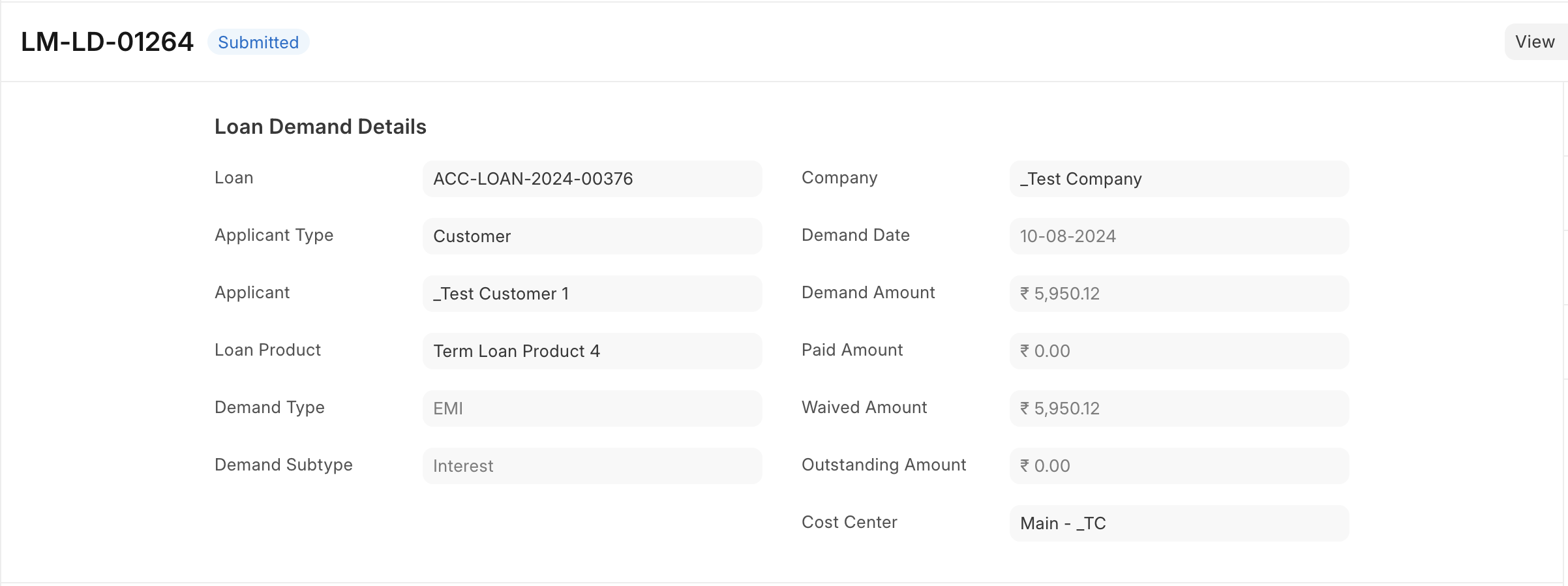

Once the waiver entry is submitted the overdue demands are knocked off as per the amount waived and the waived amount is updated in the respective demands

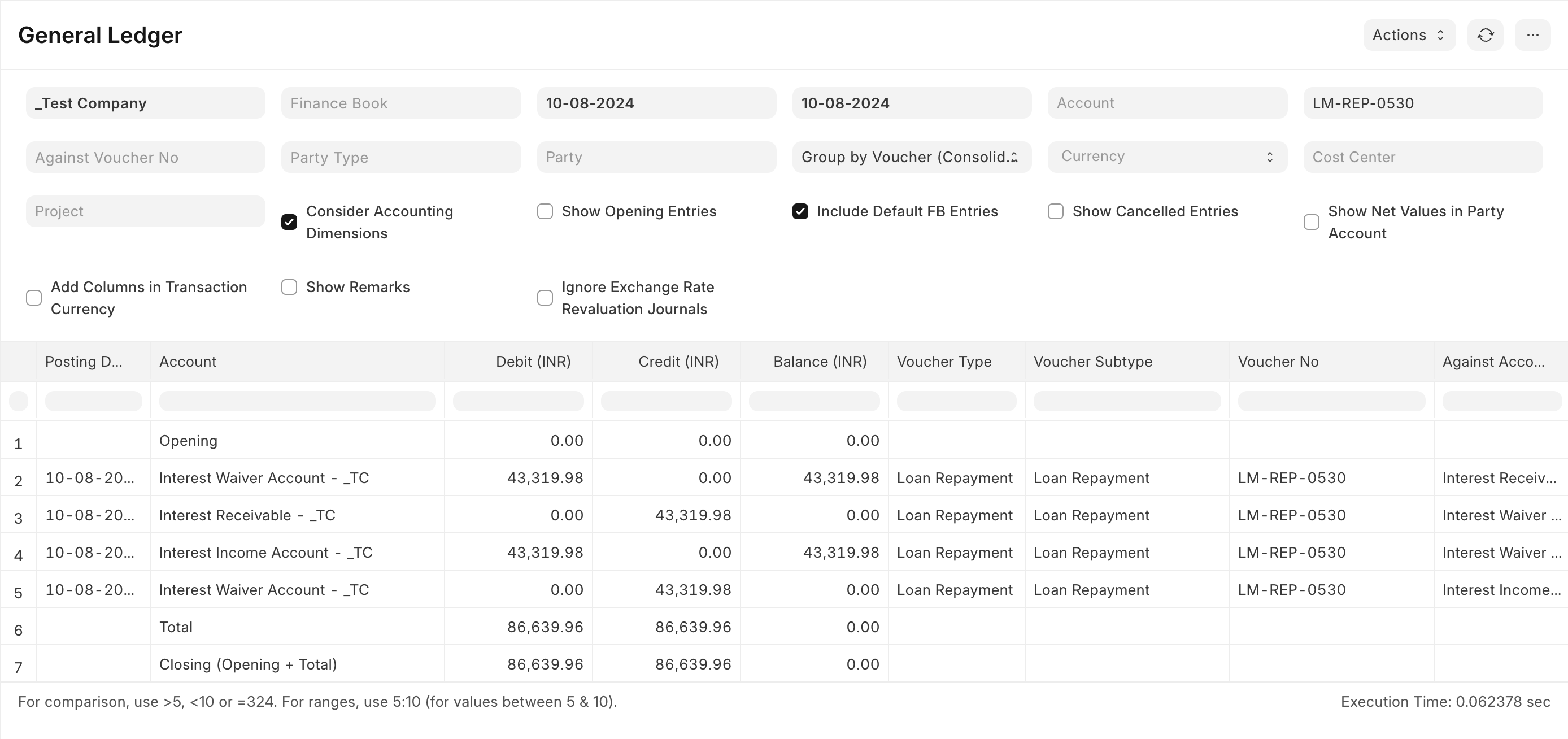

On submitting an Interest Loan Waiver, below are the typical accounting entries that are posted

As you can see in the above screenshot income booking is also reversed in case the waiver is done on a non-NPA loan.