Adjust Withhold Amount in the Payment Entry

###Question

Let's assume that outstanding against a Sales Invoice is 20,000. When client makes payment, they will only pay 19,600. Rest 400 will be booked under Withhold account. How to manage this scenario in the Payment Entry.

###Answer

In the Payment Entry, you can mention Withhold Account in the Deductions or Loss table. Detailed steps below.

####Step 1: Setup Withhold Account

Create a Withhold Account in your Chart of Accounts master.

`Accounts > Chart of Accounts'

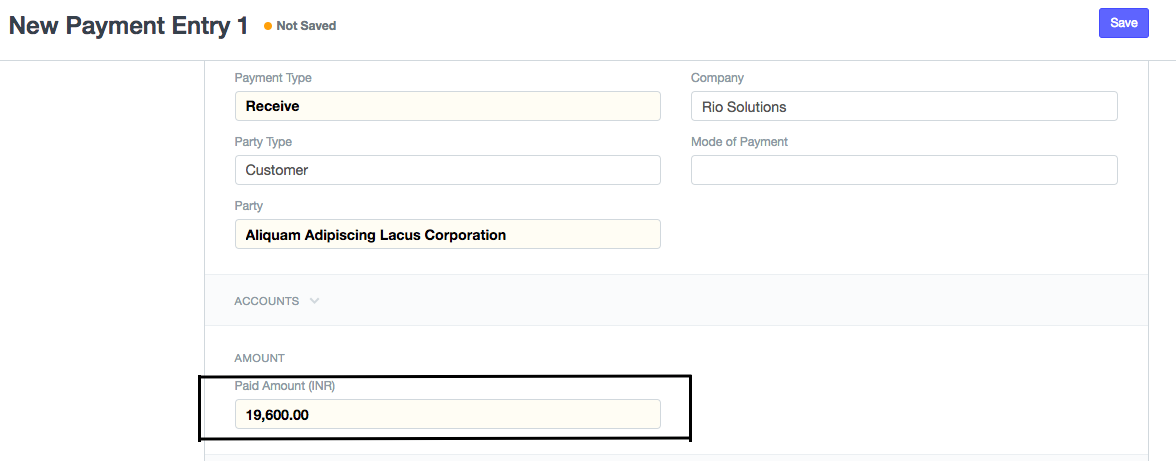

####Step 2: Payment Entry

To create Payment Entry, go to unpaid Sales Invoice and create click on Make Payment button.

#####Step 2.1: Enter Payment Amount

Enter Payment Amount as 19,600.

#####Step 2.2: Allocate Against Sales Invoice

Against Sales Invoice, allocate 20,000 (explained in GIF below).

#####Step 2.3: Add Deduction/Loss Account

You can notice that there is a difference of 400 in the Payment Amount and the Amount Allocated against Sales Invoice. You can book this difference account under Withhold Account.

Following same steps, you can also manage difference availed due to Currency Exchange Gain/Loss.