Employee Tax Exemption Declaration

Tax exemption is the monetary exemption of income, property or transactions from taxes that would otherwise be levied on an Employee.

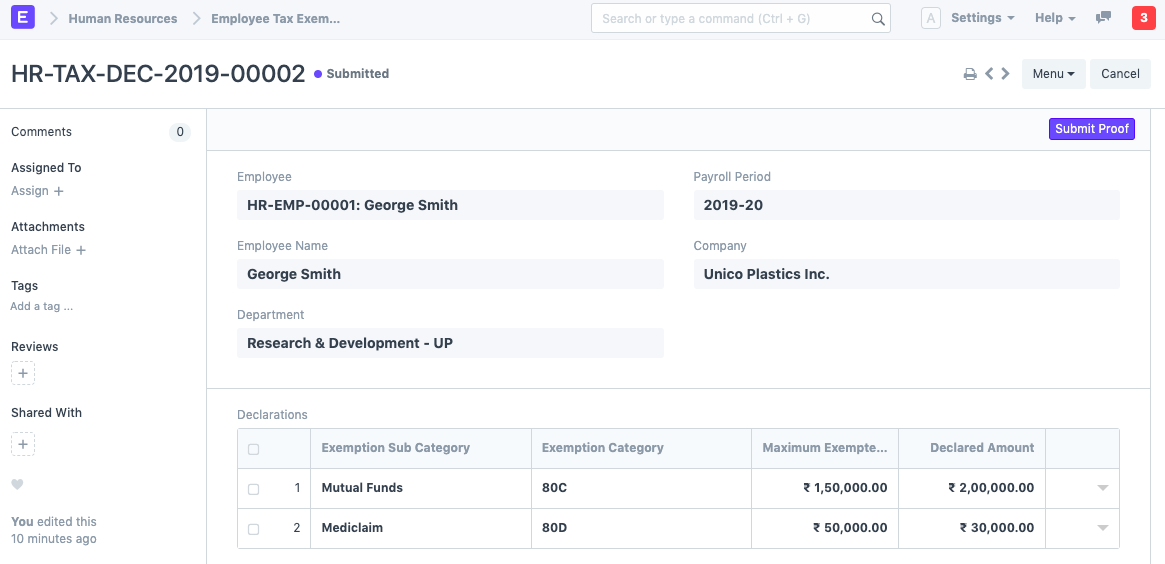

At the beginning of a Payroll Period, employees can declare the amount of exemption they will be claiming from their taxable salary. ERPNext allows you to specify tax exemption category/sub-category, tax exemption amount and other related information in the Employee Tax Exemption Declaration form.

To access Employee Tax Exemption Declaration, go to:

Home > Human resources > Employee Tax and Benefits > Employee Tax Exemption Declaration

1. Prerequisites

Before creating an Employee Tax Exemption Declaration, it is advisable you create the following:

2. How to create Employee Tax Exemption Declaration

To create a new Employee Tax Exemption Declaration:

- Go to: Employee Tax Exemption Declaration > New.

- Select the Exemption Sub Category and Exemption Category.

- Enter the Maximum Exemption Amount and Declared Amount.

- Save and Submit.

The Total Exemption Amount will be exempted from annual taxable earnings of the employee while calculating the tax deductions in Payroll.

Note: Employees can only submit one Employee Tax Exemption Declaration for a Payroll Period.

3. Features

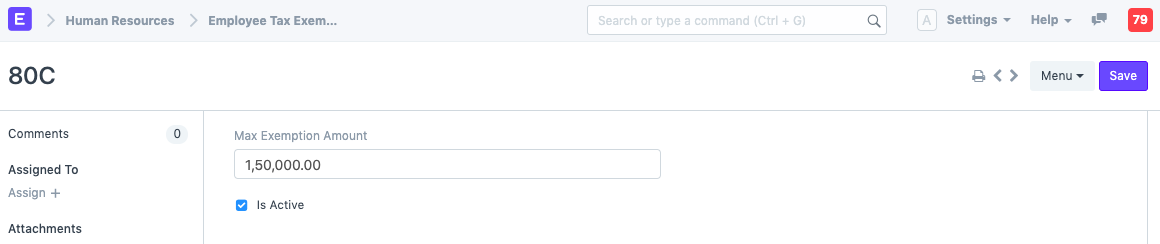

###3.1 Employee Tax Exemption Category

Exemptions from taxable salary are usually restricted to spendings on particular categories decided by the Government or regulatory agencies. ERPNext allows you to configure various categories which are allowed to be exempted. Examples of these (for India) could be, 80G, 80C, B0CC etc.

You can configure Employee Tax Exemption Category by going to, Employee Tax and Benefits > Employee Tax Exemption Category

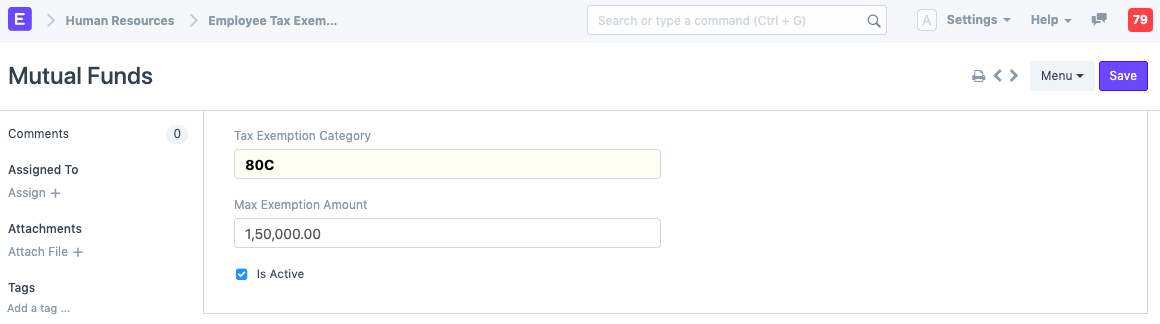

3.2 Employee Tax Exemption Sub-Category

Under each category, there could be many heads for which the exemptions are allowed. For example, in India, sub categories under 80C could be Life Insurance Premium

You can configure Employee Tax Exemption Category by going to, Employee Tax and Benefits > Employee Tax Exemption Sub-Category

3.3 HRA Exemption (Regional - India)

For the current fiscal year, in India, House Rent Allowance (HRA) exemption from taxable earnings is the minimum of:

- The actual amount allotted by the employer as the HRA.

- Actual rent paid less 10% of the basic salary.

- 50% of the basic salary, if the employee is staying in a metro city (40% for a non-metro city).

As part of the Employee Tax Exemption Declaration, employees can also fill out the HRA Exemption. ERPNext calculates the exemption eligible for HRA and exempts it while calculating the taxable earnings.

Enter the Monthly House Rent and check the 'Rented in Metro City' checkbox if applicable and submit the form. The Annual and Monthly HRA Exemption will be automatically calculated.

Once the declaration is submitted, you can submit the proof of your tax exemption by clicking on the Submit Proof button.

Note: HRA component needs to be configured in Company master under HRA Settings sections for the HRA exemption to work.