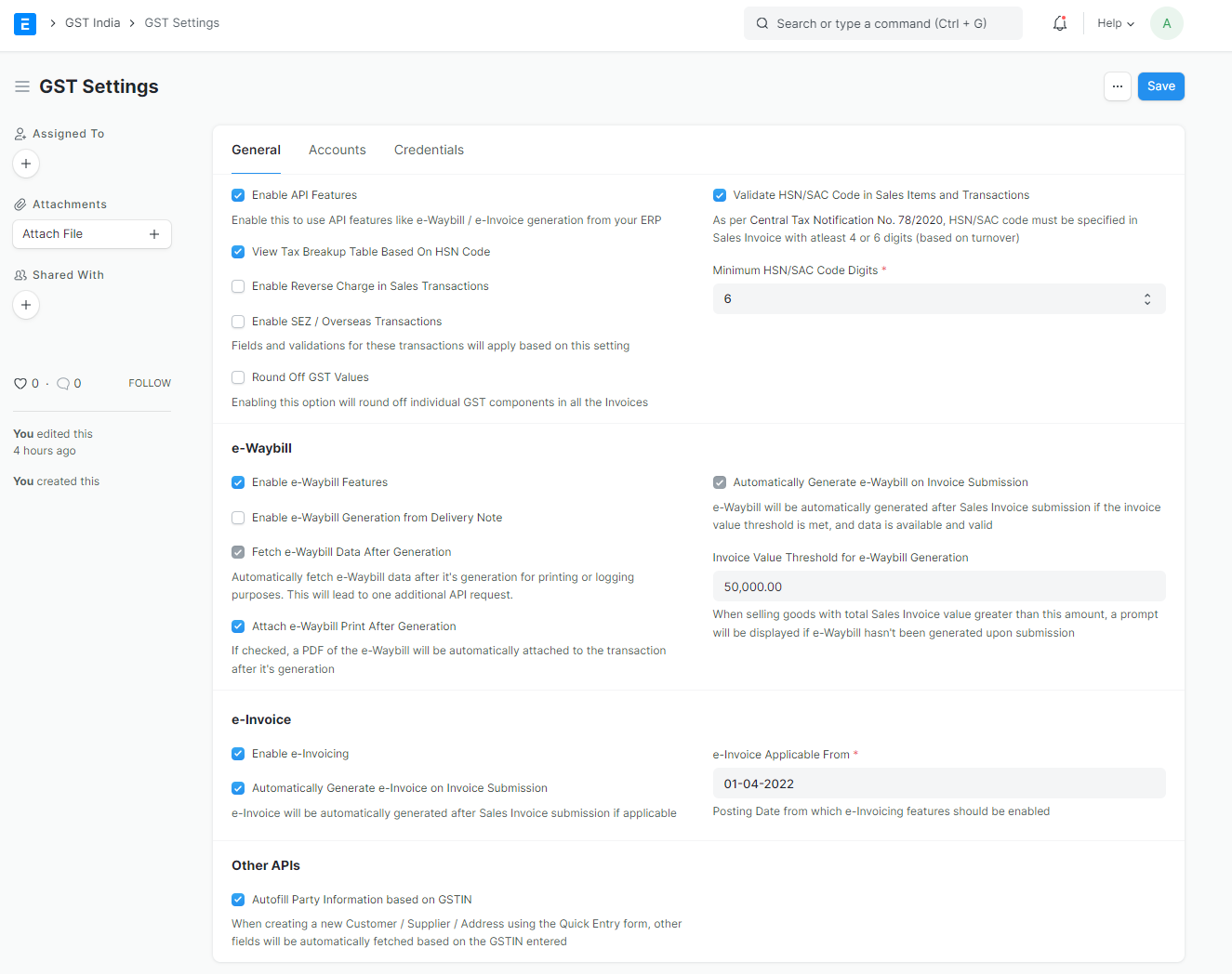

General Settings

View Tax Breakup Table Based On HSN Code: Tax Breakup Table in Sales Invoice or Purchase Invoice is generally available item-wise. If this is enabled, the tax breakup table shall be HSN Wise.

Enable Reverse Charge in Sales Transactions: Enable this setting, if reverse charge is applicable on goods/services you sell.

Enable SEZ / Overseas Transactions: Enable if you deal in Import / Export transactions with SEZ / Overseas Entity. A few fields or validations are simplified in case its not applicable to you.

Round Off GST Values: Enabling this option will round off individual GST components in all the invoices.

Validate HSN Code in Sales Item and Transactions: As per Central Tax Notification No. 78/2020, HSN/SAC code must be specified in Sales Invoice with minimum of 4 or 6 digits (based on turnover). Even HSN/SAC is made mandatory for selling items.

Minimum HSN/SAC Code Digits: Validation for minimum HSN/SAC code digits can be set here based on your turnover.

Other GST Settings specific to e-Waybill and e-Invoice are covered in respective sections.

Accounts

GST Accounts form a very important part of GST Settings. Many validations and calculations are based on these settings.

You should have 3 rows for each company in GST Accounts one for each Input, Output and Reverse Charge Accounts.

Specify individual CGST / SGST / IGST / Cess Accounts as created and applicable to you.

Correct usage of accounts and taxes is validated based on these settings. Also important calculations like taxable value or ITC Availability are calculated based on these settings.

It is important to note that multiple GST accounts are not recommended and allowed for simplicity. You can maintain only one GST Account for multiple tax rates or even for Multi-GSTIN setup for your company. Further Analysis and breakup is easy to establish from the transactions without the need of maintaining multiple accounts, and hence this simplicity.