Employee Benefits in HRMS

Flexible benefit plans allow employees to avail the benefits they want or need from a package of programs offered by an employer. They may include health insurance, pension plans, telephone expenses, etc.

To set Flexible Benefits in Frappe HR, follow the following steps:

Types of Benefits

Once Is Flexible Benefit is enabled for a salary component, user can choose how to pay it out based on following scenarios:

Accrue and payout at end of payroll period

- The benefit amount accrues each payroll cycle and is fully paid out in the final cycle.

Accrue per cycle, pay only on claim

- The benefit accrues each cycle but is paid only when the employee submits an Employee Benefit Claim.

- Payout is processed via Additional Salary.

- Optional: Any unclaimed accrued balance can be auto-paid in the final cycle by enabling Payout Unclaimed Amount in Final Payroll Cycle.

Allow claim up to the full period limit

- The employee can claim the entire annual benefit in one go. No accruals are created.

> Note: If Depends on Payment Days is enabled for a component, the monthly entitlement will be adjusted accordingly.

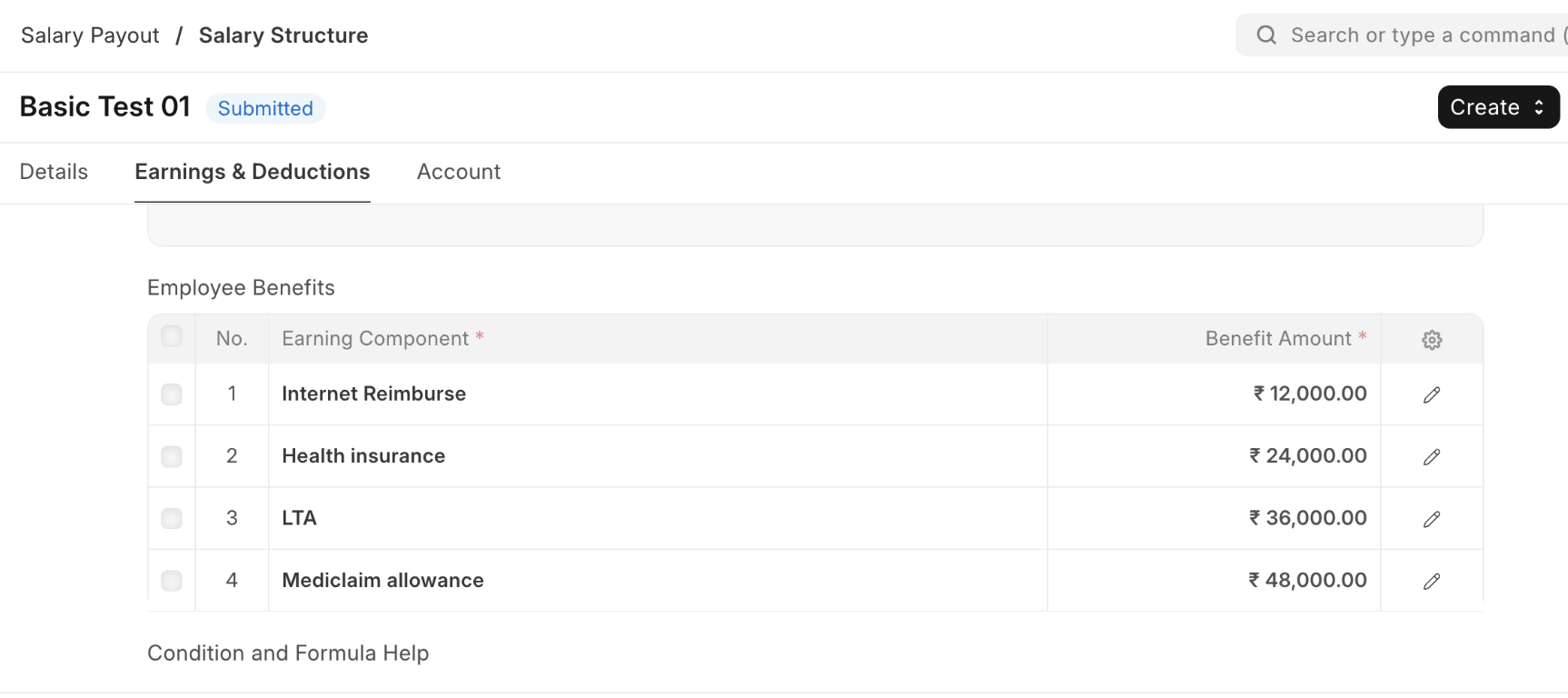

Assigning Employee Benefits to Employees

- Configure employee benefits and their yearly amount in the Salary Structure. This acts as the template for employee benefits.

- When a Salary Structure is assigned to an employee, these details are copied into the Salary Structure Assignment and can be edited further if required.

- The final list and amounts in the Salary Structure Assignment are what the system considers.

Employee Benefit Application

- Employees can opt for the benefits they want from those assigned in their Salary Structure Assignment.

- If no Benefit Application exists, the system falls back to the Salary Structure Assignment.

- To make a Benefit Application mandatory, enable Mandatory Benefit Application in Payroll Settings.

Employee Benefit Ledger

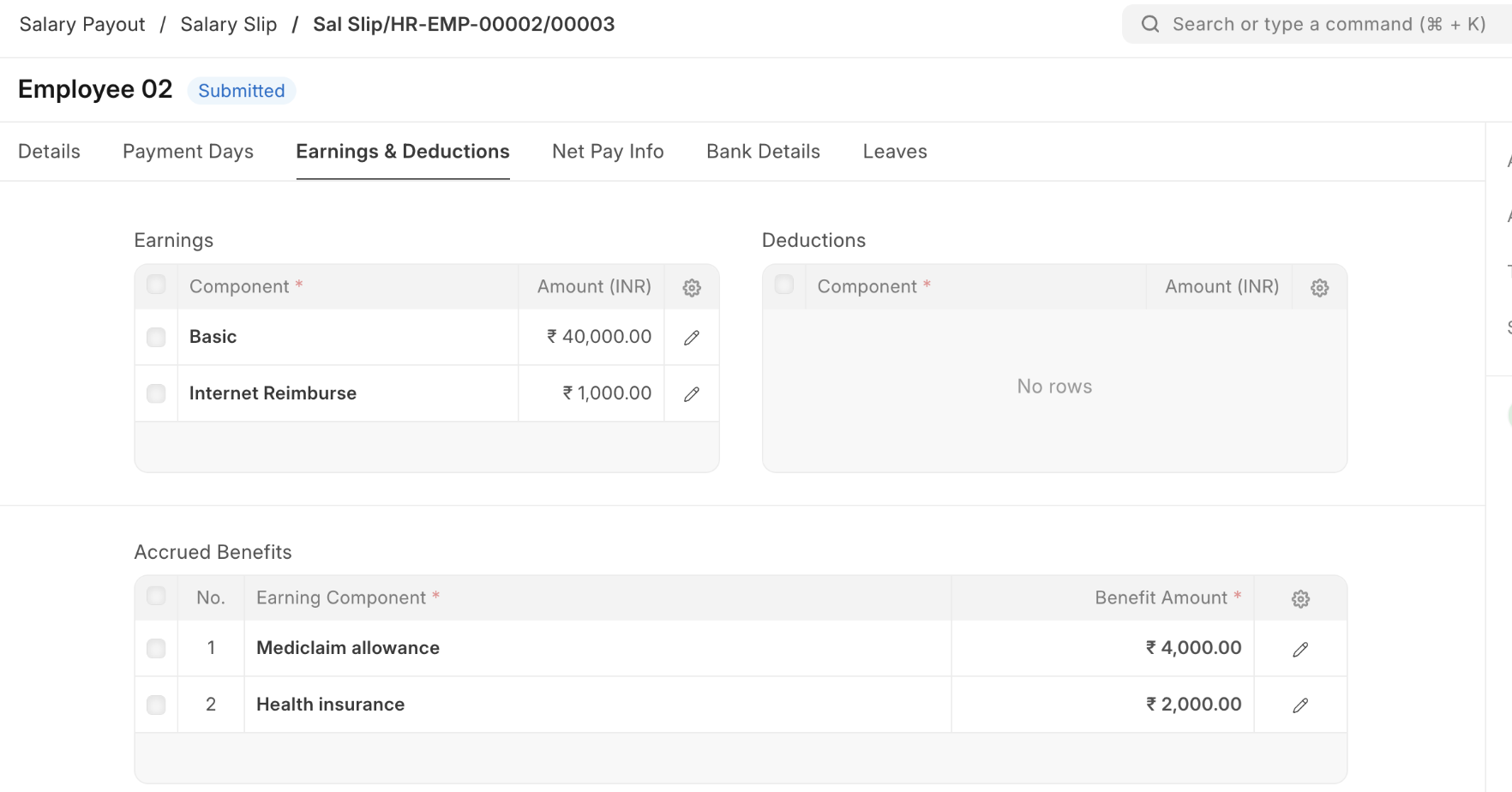

In the Salary Slip:

- Accrued Benefits appear in the Accrued Benefits table.

- Payouts appear as Earnings.

After salary is processed, a Benefit Ledger Entry is created for every accrual and payout to keep track of balances.

Employee Benefit Claim

Claims can be submitted only for these payout types:

Accrue per cycle, pay only on claim

- Claim limit = Total accrued so far + Current month’s entitlement

Allow claim up to the full period limit

- Claim limit = Total assigned amount

Accrual Component in Salary Component

A new checkbox Accrual Component is available in the Salary Component doctype.

Example use case:

HR wants to record a Loyalty Bonus equal to 5% of basic salary every month and pay it out after 10 months.

Create a Salary Component Loyalty Bonus, enable Accrual Component, and add it to the Salary Structure with a formula.

This accrual will:

- Show in the salary slip as Accrued Earnings.

- Not be included in gross pay or accounting entries.

- Create an Employee Benefit Ledger entry for tracking.

At the end of 10 months, the employer can create an Additional Salary for the accrued amount, which will then flow into gross pay, accounting, and tax calculations.

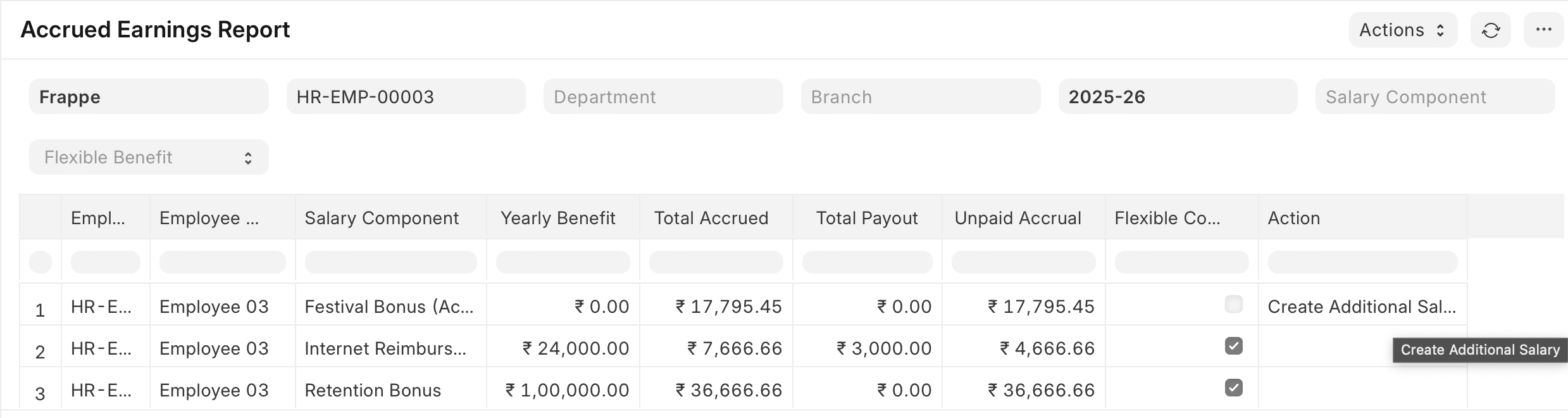

Accrued Earnings Report

A report to track total accruals and payouts.

- For standard accruals, users can create an Additional Salary for pending payouts directly.

- For flexible benefits, payouts must be done via an Employee Benefit Claim.